Climate Change-Related Disclosure in Accordance with the TCFD Recommendations

The AMADA Group recognizes that addressing climate change is one of the most important management issues for corporate management, and in April 2022 we declared our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) . We disclose information based on the TCFD framework, including assessments (scenario analysis) of the impact of climate change-related risks and opportunities on our business.

For more information on our initiatives to address climate change, please see the page linked below.

Realizing a Decarbonized Society

Governance

Amada Group addresses environmental issues, including climate change, through its Environmental Eco Committee, which operates under the supervision of the Sustainability Committee chaired by the President and Representative Director. Please see below for more details.

Environmental management system

Strategy

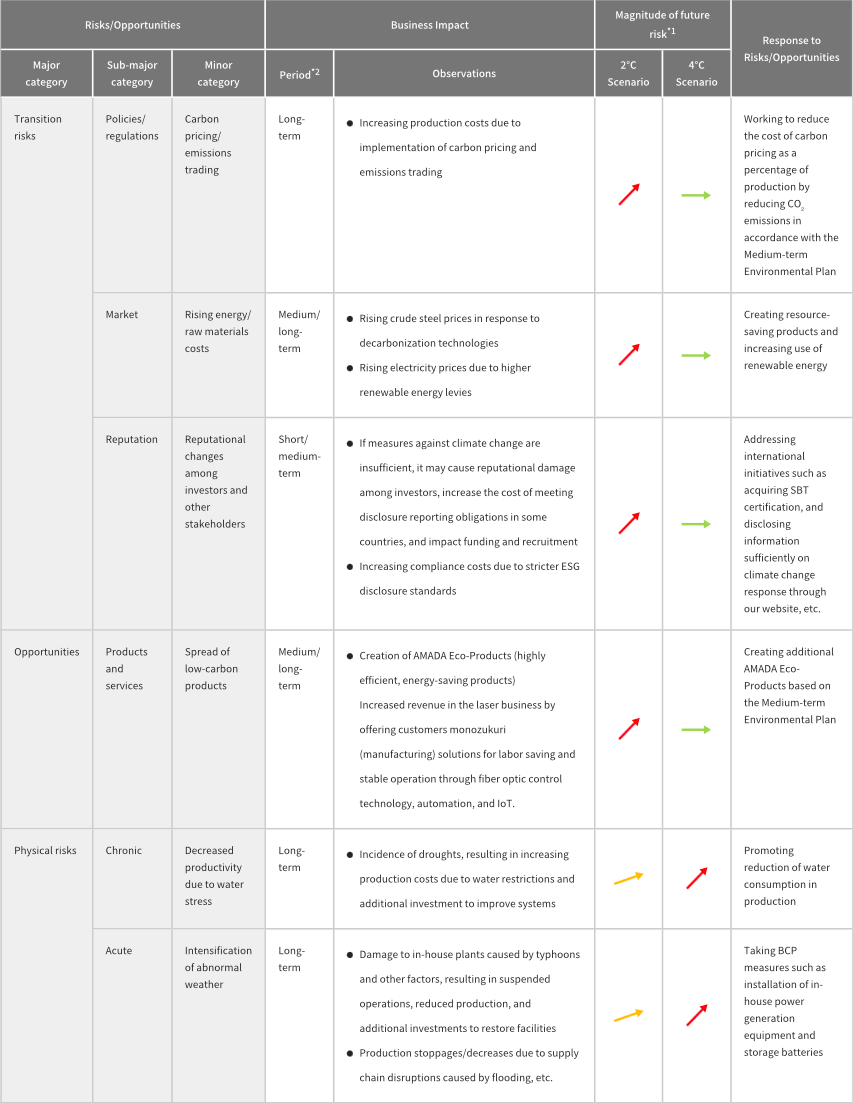

There are two main types of risks and opportunities related to climate change: Transition, such as changes in laws and regulations, technologies, and market product preferences as society moves toward carbon neutrality; and physical, such as the actual increases in average temperatures and the resulting abnormal weather and chronic weather changes. According to this framework of two kinds of risks and opportunities, the AMADA Group has conducted an assessment of the nature of each, their impact on its business activities, and the duration of impact, identifying each risk and opportunity as listed below. The following also indicates our response and the financial impact for these risks and opportunities. In identifying risks and opportunities, we conduct a multi-scenario analysis to reflect the results.

In its main 2°C scenario, the AMADA Group considers the creation of highly efficient energy-saving AMADA Eco-Products and the product strategy to reform monozukuri (manufacturing), such as fiber-optic control technology and automation in the laser business, as important in that they offer opportunities to boost sales.

Major climate change-related risks and opportunities

Major climate change-related risks and opportunities

- *1Risks and opportunities are assessed under two scenarios: The 2°C scenario and the 4°C scenario. The 2°C scenario adopts the IEA’s SDS and the Intergovernmental Panel on Climate Change (IPCC)’s Representative Concentration Pathway (RCP) 2.6 scenario as external scenarios.

The 4°C scenario, on the other hand, refers to the IEA’s Current Policies Scenario (CPS) and the IPCC’s RCP8.5 scenario as external scenarios.

Risk magnitude is indicated as follows: “ ” for ¥1 billion or more, “

” for ¥1 billion or more, “ ” for ¥100 million to ¥1 billion, and “

” for ¥100 million to ¥1 billion, and “ ” for less than ¥100 million.

” for less than ¥100 million. - *2Periods indicated are as follows. Short-term: 1 year, Medium-term: 1–3 years, Long-term: 3+ years.

Financial impact from climate change-related risks (2°C scenario)

Under the 2°C scenario, which is expected to have a greater impact on the AMADA Group, the financial impact of climate change-related risks is estimated as follows.

Regarding the risk that a future increase in carbon prices will lead to higher costs, we estimate the costs that would be required to be paid if the carbon price in 2030 were ¥10,000/t-CO₂, adopted based on price assumptions for developed countries in the International Energy Agency (IEA)’s Sustainable Development Scenario (SDS).

| Indicator | Year for assumption | Assumed unit price | Assumed CO₂ emissions* | Expenses |

|---|---|---|---|---|

| Carbon price | 2030 | ¥10,000/t-CO₂ | 14,796 t-CO₂ | ¥148 million |

- Assumed CO₂ emissions are 75% less than fiscal 2013 Scope 1 and Scope 2 emissions for all business sites and plants, based on Group targets.

Risk management

The AMADA Group’s Environment ECO Committee is responsible for management and action with regard to climate change-related risks. Identified risks and opportunities are reported to the risk management division set up under the Internal Control and Risk Management Committee. The Internal Control and Risk Management Committee establishes policies on important risks at the Group level related to people, goods, money, information, etc., and manages these and other risks in an integrated manner. Results from risk management activities are reported to the Board of Directors at the end of the fiscal year for use in management decision-making.

Major Climate Change-Related Risks and Opportunities

- Collect information on climate change from domestic and overseas business sites, and assess climate change risks and opportunities (including scenario analysis) through the AMADA Group’s Environment ECO Committee.

- Report climate change risks and opportunities identified by the committee to the Internal Control and Risk Management Committee.

The Internal Control and Risk Management Committee carries out risk management of these and other risks in an integrated manner. - The Internal Control and Risk Management Committee reports risk management results to the Board of Directors once a year at the end of the fiscal year.

Indicators and targets

The AMADA Group has set its Groupwide targets for managing risks and opportunities related to climate change as a 75% reduction of Scope 1 and Scope 2 CO₂ emissions as of 2030 compared with fiscal 2013 and a 50% reduction of Scope 3 Category 11 (Use of sold products) CO₂ emissions as of 2030 compared with fiscal 2013, and is working to achieve these targets. Please refer to Medium-term Environmental Plan for details on other environmental action plans.

For actual CO₂ emissions for Scope 1, Scope 2, and Scope 3, please refer to our ESG Data.