Long-term Vision / Medium-term Business Plan

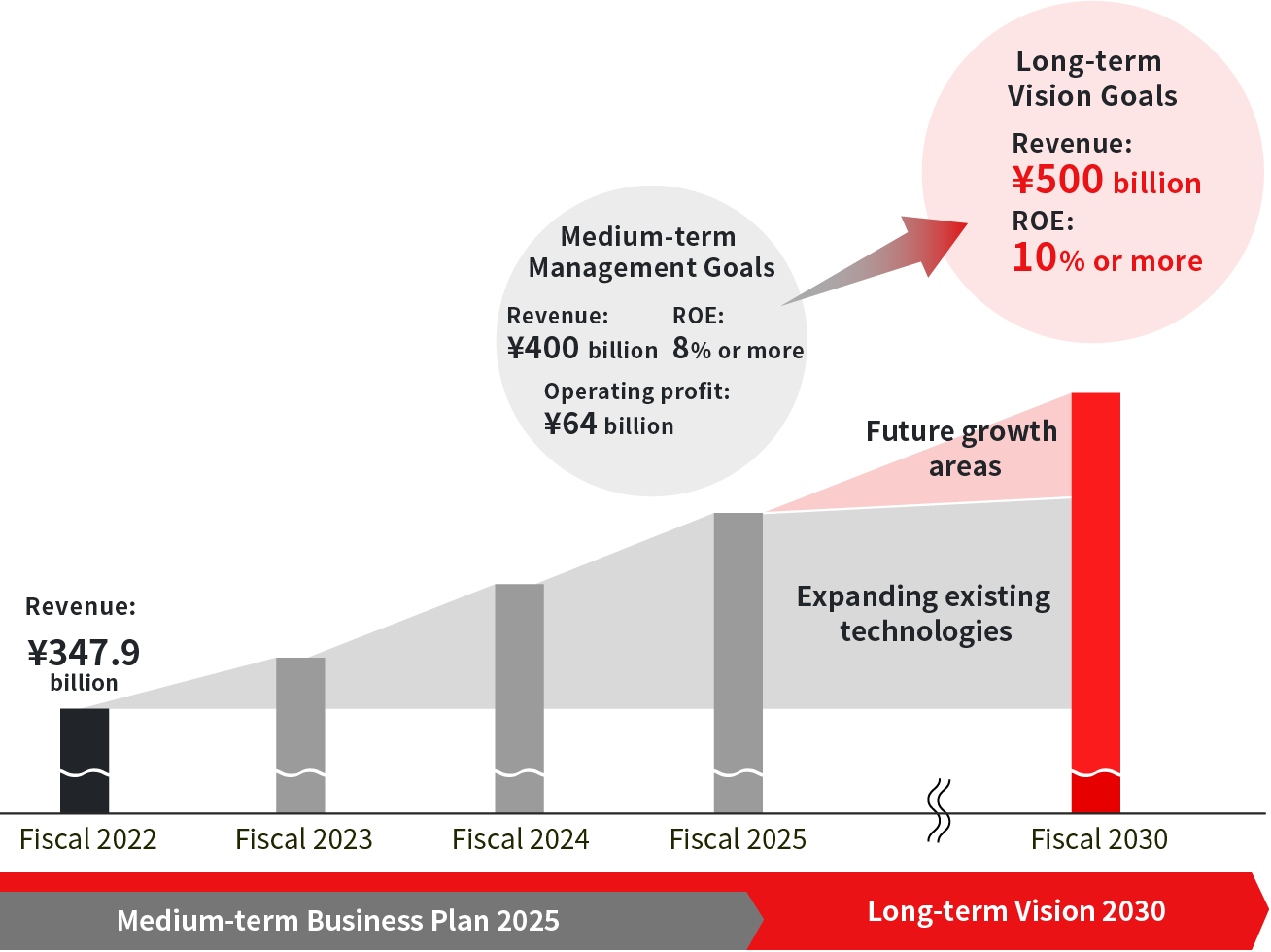

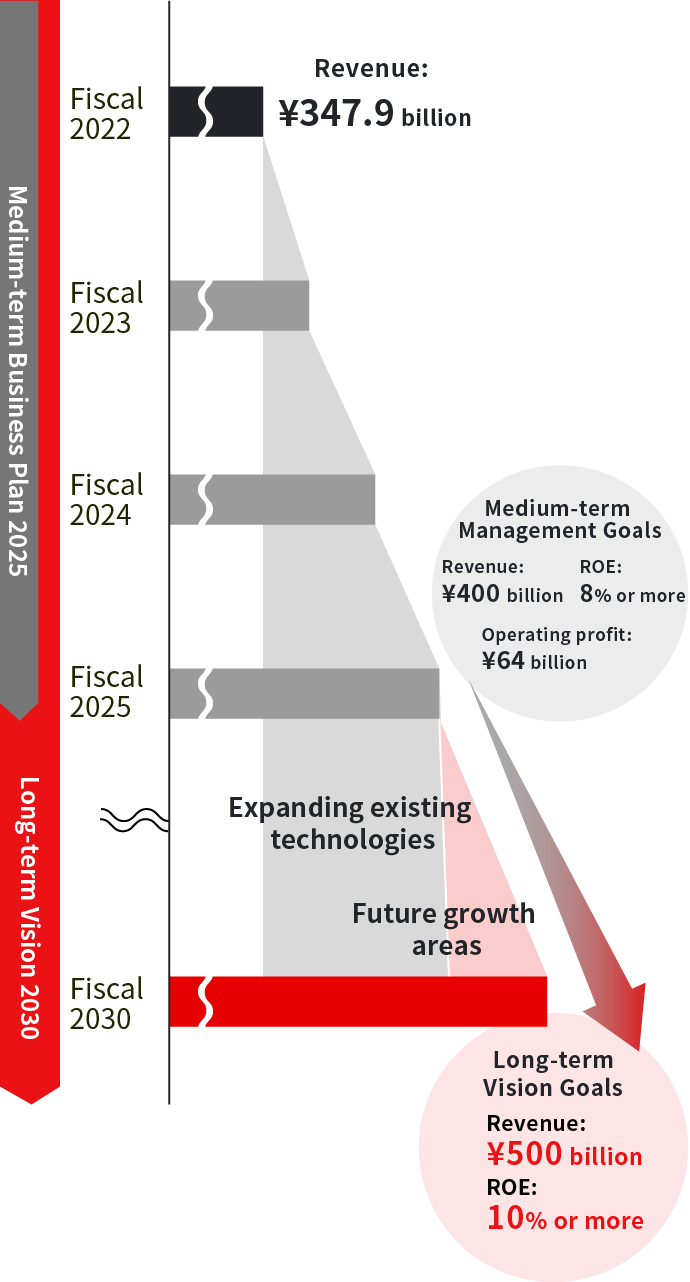

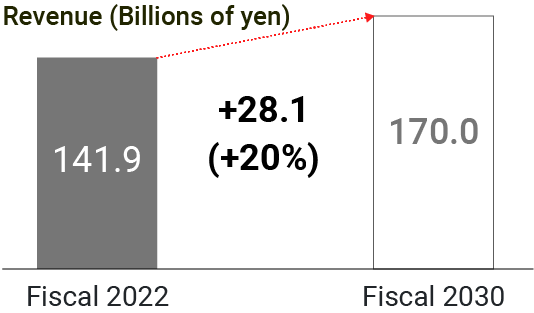

In May 2022, the AMADA Group announced its new Long-term Vision 2030 as its vision for the year 2030, founded in its five management philosophies, including “Growing Together with Our Customers.” In May 2023, we also formulated and announced our Medium-term Business Plan 2025 for the three years from fiscal 2023 as a specific action plan for sustainable growth and enhancement of corporate value.

Our Management Philosophy

- 1Growing together with our customers

- 2Contribute to the international community through our business

- 3Develop human resources who pursue creative and challenging activities

- 4Conduct sound corporate activities based on high ethics and fairness

- 5Take good care of people and the earth’s environment

Social contributions through manufacturing and being the customer’s best partner in manufacturing

Long-term Vision / Medium-term Business Plan

Developing new products to

help resolve social issues

Reducing environmental

Reducing environmental

impact, improving

productivity Less skill required

Less skill required Visualization

Visualization

Toward achievement of our Long-term Vision 2030

Planting the seeds for expanding business domains into growth areas

Entering new business fields

Monetizing new domains and further expansion of existing domains

Long-term Vision 2030

Ending fiscal 2030

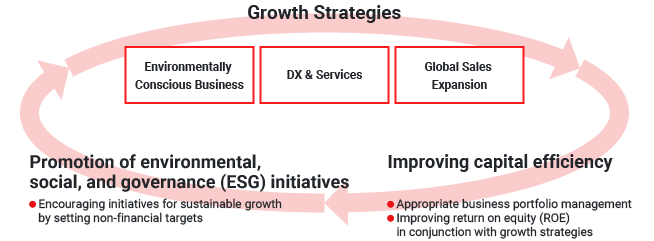

Three priority items and three growth strategies to achieve our Long-term Vision 2030

Practicing management to enhance corporate value and achieve sustainable growth

Medium-term Business Plan 2025

Fiscal 2023 to Fiscal 2025

ROE of 8% or more

Thoroughly strengthening our management foundation and improving earnings through new products and activities

Four basic strategic policies

In February 2023, we updated approximately 80% of our core sheet metal products. Given the current environment surrounding our customers, new models are focused on increasing productivity, improving processing accuracy, and contributing to the environment. The new products have high profit margins, which is key to increasing revenue and improving profitability.

We also regard the development and expansion of automation products as an important strategy which we will continue to promote.

We aim not only to automate processing in single processes but will also make new investment in the transporter devices that link different processes.

Additionally, we will roll out software and IoT services that perform control at the level of the whole factory to support digital transformation (DX) at customer production facilities.

-

- High speed and quality

Evolution of optical

technology

- Laser control technology

- Laser welding

Expanding the lineup

- High speed and quality

-

- New numerical control (NC) operation

system with advanced

technology and 4 “e”s

- New numerical control (NC) operation

-

- Electric servo

Benders

- Electric servo

-

- Automation

- Inter-process transport

- Automation

-

- Manufacturing DX solutions

- Manufacturing DX solutions

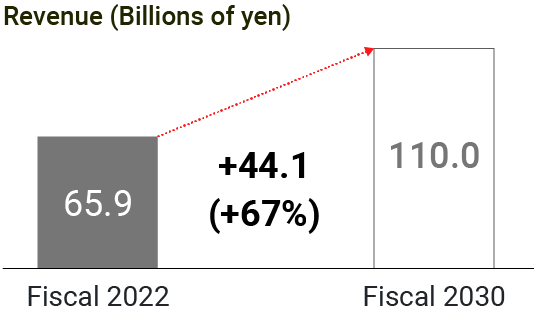

The after-sales service business is one of our strengths that is resilient to economic fluctuations and ensures stable earnings.

We will focus on five main offerings supporting customer production, with the aim of achieving sustainable profitability growth.

-

Customer support system

Using DX to restructure

our direct service system

-

Production technology

support businessEnhancing productivity

through technology support

-

Retrofitting business

Cultivating new markets

in Japan and overseas

with mechatronics and

added safety

features to existing machines

-

Factory automation

Increasing production capacity

with automation equipment and software

-

Cloud business

Supporting customer

activities with

cloud computing

The new AMADA GLOBAL INNOVATION CENTER (AGIC) is an AMADA facility designed to attract customers. This is a place where customers can work with AMADA’s engineers to solve the processing issues they are facing or develop new technologies to break into new markets.

A space for co-creating the future of metalworking together with our customers

-

Innovation SITE

Customers enjoy hands-on experiences of today’s cutting-edge technology that offers the value they expectFor greater impact of new products

-

Innovation LABO

Verifying customers’ manufacturing and tackling the challenge of future processing technologiesNew market expansion

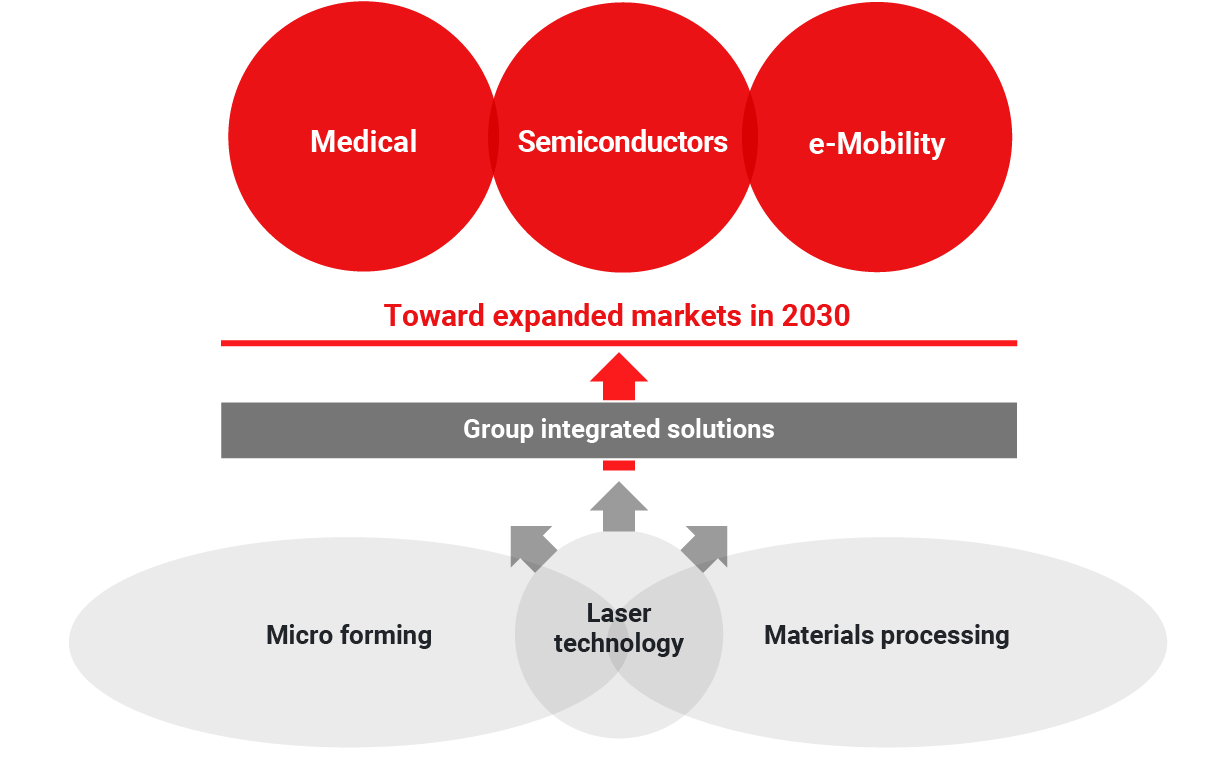

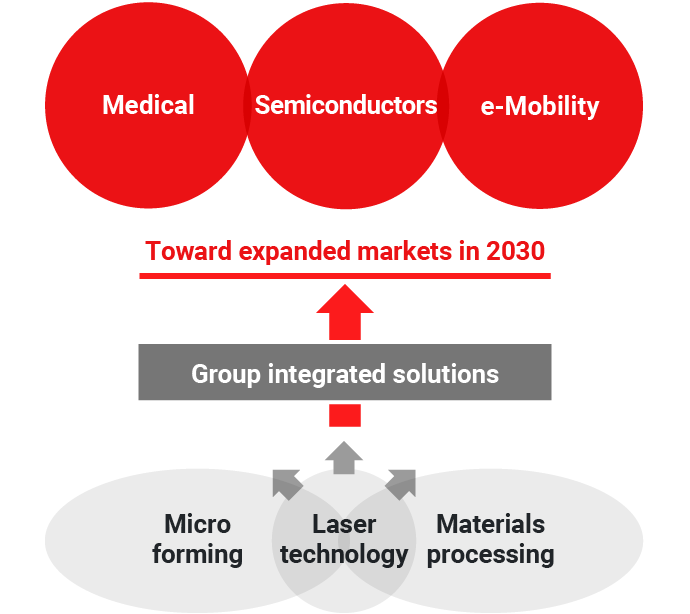

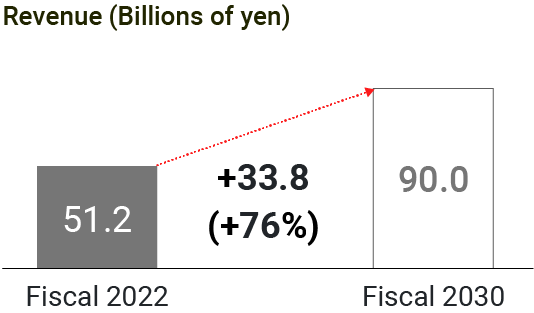

The AMADA Group was a pioneer in adopting and commercializing laser technology. Until now, our mainstay sheet metal fabrication business has focused on processing iron and stainless steel. Going forward, we will take on the challenge of expanding our business domains by targeting highly reflective materials such as copper and aluminum, non-metallic materials, and micro processing to be used in growth industries.

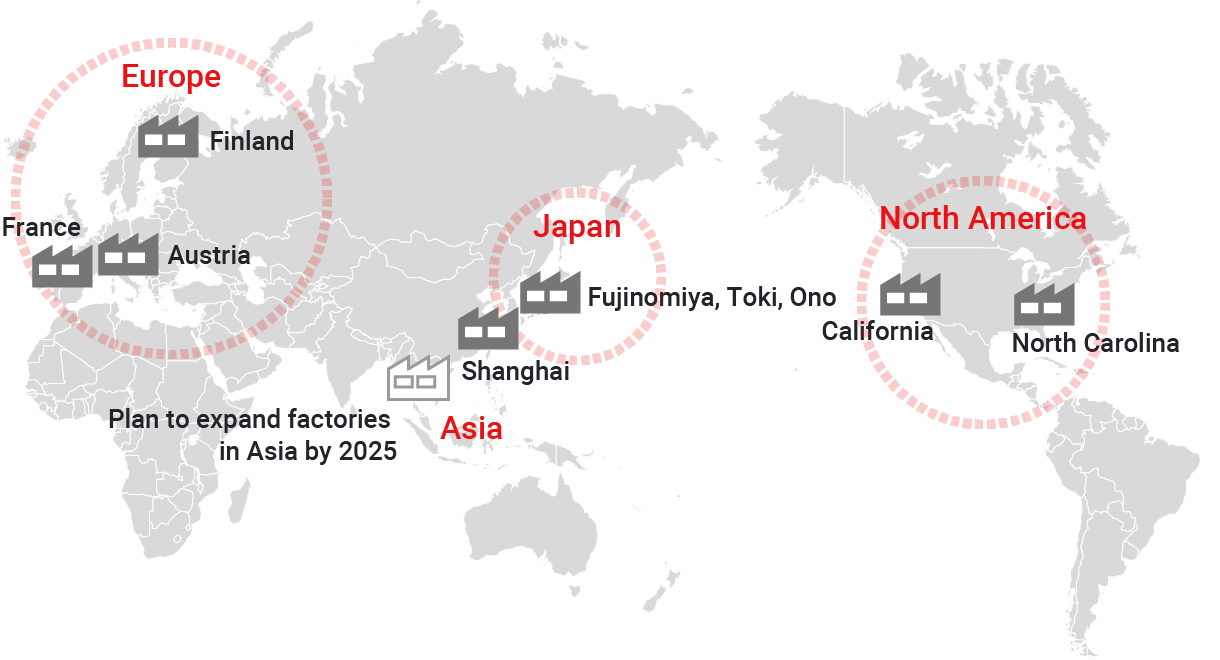

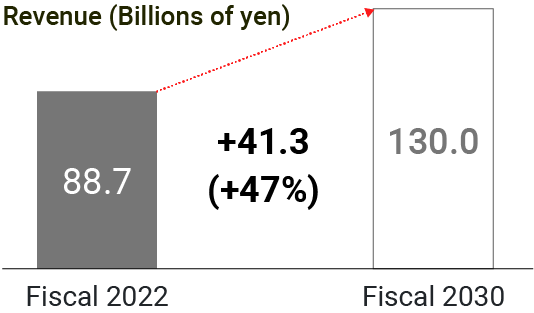

Currently, our geographic sales composition is 40% in Japan and 60% overseas. In our Long-term Vision 2030, we envision 35% in Japan and 65% overseas. To put in place an overseas supply system to support this, we will improve costs, delivery time, and inventories through local production for local consumption, and at the same time, improve profitability.

Strengthening our supply structure and improving profitability through global manufacturing transformation

Immediate delivery system through local production for local consumption, global standard quality, reinforcing cost competitiveness, and enhancing appropriate inventories (supply chain management [SCM] strategy)

- Japan

- North America

- Europe

- Asia

We will shift from investment centered on expansion of production capacity to balanced investment that includes intangible aspects (DX, research and development, the environment, and human resources), and make further future growth investments.

| Research and development/M&A Approx. ¥50–60 billion |

Research and development: Building new processing technologies and providing products with strong soft aspects/environmental friendliness Synergy development: Strengthening the Group’s market and manufacturing strategies M&A: Accelerating new business expansion |

|---|---|

| Supply system Approx. ¥20–30 billion |

Asian supply strategy (including global procurement) North American supply strategy (strengthening automation systems) |

| IT/DX Approx. ¥10 billion |

Global customer relationship management (CRM) construction, security investment, manufacturing and supply coordination system construction |

| Human resource investment Approx. ¥10 billion |

Technical education centers, reskilling, DX/global human resource development |

| Environmental investment Approx. ¥10 billion |

Environmental investments in business sites and manufacturing, improving manufacturing efficiency |

| Total: Approx. ¥100– 120 billion |

Medium-term Business Plan 2025 |

| Strategic/renewal investment | ¥100–120 billion |

|---|---|

| Working capital | ¥100 billion |

| Shareholder returns | ¥100–120 billion |

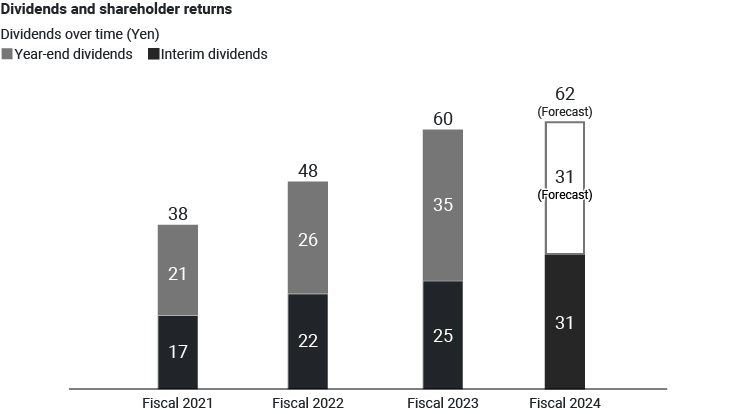

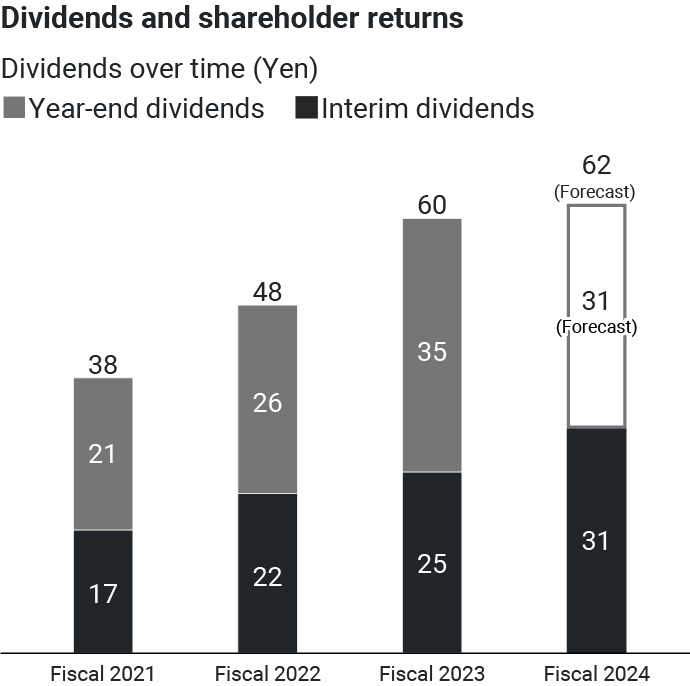

- Setting the annual dividend amount to target a consolidated dividend payout ratio of 50% and to maintain a dividend on equity (DOE) ratio within the range of approximately 3% to 4%

- Planning continuous and phased share buybacks in consideration of cash flows and other factors, assuming a limit of ¥40 billion to ¥60 billion in buybacks

■ Shareholder returns

In accordance with our shareholder return policy, we conducted share buybacks worth approximately ¥20 billion in fiscal 2024, in addition to the above dividends. In fiscal 2025, we are planning share buybacks for a maximum total of ¥20 billion in shares. We will continue to apply our shareholder return policy with an eye to achieving stable dividends and improving ROE.

| Results from fiscal 2022 | Results from fiscal 2023 | Planned for fiscal 2024 | Planned for fiscal 2025 | |

| Annual dividends paid (Dividend payout ratio) |

¥48 (48.9%) |

¥60 (50.4%) |

¥62 (62.8%) |

¥62 (64.3%) |

| Dividend on equity ratio (DOE) | 3.3% | 3.8% | 3.9% | 3.9% |

| Purchase of treasury shares | − | ¥20.0 billion | ¥20.0 billion | ¥20.0 billion |

| Total return ratio | 48.9% | 99.7% | 124.6% | 128.8% |

| Indicator | Data Coverage | FY2022 Result |

FY2023 Result |

FY2025 Target |

FY2030 Target |

|

| Environment | Reduction of product CO2 emissions |

Group Consolidated (vs. FY2013) |

58.4% reduction |

68.9% reduction (prospective) |

50.0% reduction |

50.0% reduction |

| Reduction of business site CO2 emissions |

73.4% reduction |

77.8% reduction (prospective) |

70.0% reduction |

75.0% reduction |

||

| Society | Education and training hours per employee |

Major group companies in Japan* | 47.7 hours | 41.7 hours | 40.0 hours | 45.0 hours |

| Number of female managers |

15 | 17 | 24 | 40 | ||

| Rate of female new graduates hired |

32.6% | 27.6% | 25% | 25% | ||

| Paid leave acquisition rate |

74.3% | 77.1% | 80% | 100% | ||

| Childcare leave acquisition rate (Men/Women) |

68.2%/100% | 82.5%/100% | 70%/100% | 100%/100% | ||

| Governance | Ensuring diversity on the Board of Directors |

Group Consolidated | External directors: 4 of 9 Female directors: 1 |

External directors: 4 of 9 Female directors: 1 Female auditors: 1 |

Increase in diversity | Maintenance / Increase |

| Review of the officer remuneration system |

– | Introduction of stock compensation system linked to the achievement of medium-term business plan | Introduction of medium- to long-temr incentive plan | Reinforcement of management structure | ||

*The major companies in Japan refer to the following five entities: Amada Co., Ltd., Amada Machinery Co., Ltd., Amada Weld Tech Co., Ltd., (On April 1, 2024, it merged with Amada and has been dissolved.), Amada Press System Co., Ltd., and Amada Tool Co., Ltd.

After-Sales

Services to

Support Customer

Production