Corporate Governance System

Basic views

At the Company, we believe that sound corporate activities based upon high ethical standards and fairness make a crucial part of our business philosophy, and thus we shall endeavor to strengthen corporate governance according to the principles stated below, ensuring the transparency and compliance across our management and operations as our fundamental objective:

- Strive to protect shareholders’ rights and ensure the equitable treatment of all shareholders

- Strive to appropriately collaborate with stakeholders other than shareholders

- Strive to ensure proper disclosure and transparency of information

- Strive to have the Board of Directors appropriately fulfill its roles and responsibilities, reflecting upon fiduciary duty and accountability to the shareholders

- Strive to have constructive dialogue with shareholders

The Company shall establish the Corporate Governance Guidelines, resolved by the Board of Directors, for the purpose of achieving sustainable growth and improving the Company’s long-term corporate value so that the Company’s shares are held on a long-term basis by its shareholders. The Corporate Governance Guidelines can be viewed on the Company’s website.

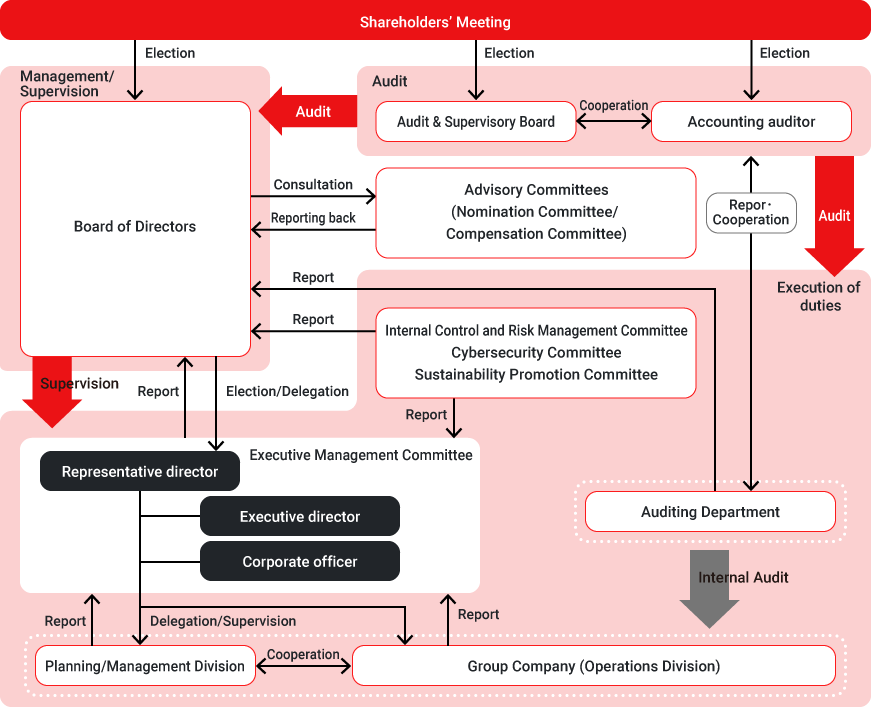

Chart of Corporate Governance Structure

Corporate Governance System

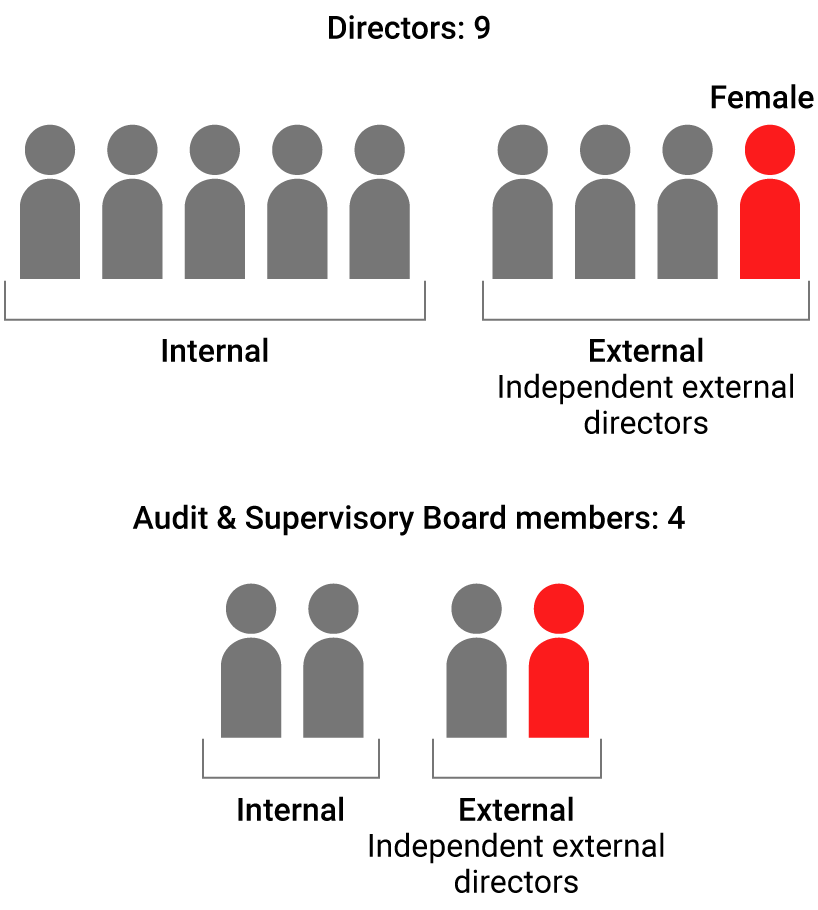

The Board of Directors makes decisions on matters stipulated by laws and regulations and other important matters related to general management, and is positioned as an entity that monitors the execution of duties by directors. Also, the Board currently comprises nine directors, including four external directors. Board meetings are held as required in order to make prompt and flexible management decisions.

Furthermore, the Company has adopted an Audit & Supervisory Board member system, and two of the four members are outside auditors. The Company’s Audit & Supervisory Board members monitor corporate governance with the mission of responding to the trust of shareholders and the demands of society. This is done by attending meetings of the Board of Directors and other important meetings, hearing reports on business from directors and other relevant personnel, examining the status of operations and assets, and inspecting important documents.

The Company will continue to further enhance its organizational structure and mechanisms, focusing on statutory functions such as the General Meeting of Shareholders, Board of Directors, Audit & Supervisory Board, and accounting auditors. We will strive to ensure accountability through prompt disclosure of management and financial information and proactive efforts in investor relations (IR) activities.

Corporate Governance Guidelines

The Company shall set forth the Corporate Governance Guidelines for the purpose of clarifying the basic views and the initiatives to be taken by it concerning corporate governance.

Corporate Governance Report

For details of the Company’s corporate governance, please refer to the “Corporate Governance Report” that we have submitted to the Tokyo Stock Exchange.

Independence Standards for Outside Officers

The Company has established “Independence Standards for Outside Officers” with the aim of clarifying standards for the independence of outside directors and outside audit and supervisory board members.

Structure and institutional design

Board of Directors

The Board of Directors limits the number of directors to a maximum of 10 as stipulated in the Articles of Incorporation. The Board currently comprises nine directors, including four external directors, all of whom are independent officers. The Board of Directors makes decisions on matters stipulated by laws and regulations and other important matters related to general management, and is positioned as an entity that oversees business execution. To fulfill this role, Board meetings are held as required in order to make prompt and flexible management decisions.

Furthermore, to increase the functionality and effectiveness of the Board of Directors, management meetings are held in a timely manner. During these, participants deliberate over important matters related to business execution and time is allotted for discussions on a select set of topics.

Audit & Supervisory Board

AMADA has transitioned to a Company with an Audit & Supervisory Board. As stipulated in the Articles of Incorporation, the number of Audit & Supervisory Board members shall be limited to a maximum of four. At least half of the Audit & Supervisory Board members shall be independent external officers with neutrality and independence. Currently, two of the four members of the Audit & Supervisory Board are independent external officers.

As an organization that is independent from the management, the Audit & Supervisory Board audits the execution of duties by directors, corporate officers, and other employees, internal control systems, accounting, and the like. To ensure the independence and quality of accounting auditors, the Audit & Supervisory Board shall formulate criteria for proper evaluation of the incumbent accounting auditors and regularly confirm whether or not they meet the set criteria.

Voluntary Committees

In April 2020, AMADA established the Nomination Committee and the Compensation Committee, both of which are chaired by an independent external director, to serve as voluntary advisory bodies for the Board of Directors with the purpose of utilizing the knowledge and advice of external directors and enhancing the independence, objectivity, and accountability of the Board of Directors. Each committee is composed of five members, with four members—over half of each committee—being independent external directors.

The Nomination Committee deliberates on the appointment and dismissal of directors, and the Compensation Committee deliberates on the policies and specifics of remuneration and other compensation received by directors and key employees. Both committees provide advice and recommendations to the Board of Directors.

| Independent external directors | Internal director | ||||

|---|---|---|---|---|---|

| Masakazu Aoki | Harumi Kobe | Hiroyuki Sasa | Toshitake Chino | Tsutomu Isobe (Representative Director) |

|

| Nomination Committee | Member | Member | Chairman | Member | Member |

| Compensation Committee | Member | Member | Member | Chairman | Member |

Evaluating the Effectiveness of the Board of Directors

Based on the Corporate Governance Guidelines, the Company conducts an annual evaluation of the effectiveness of the Board of Directors as a whole.

Evaluation Method

We distributed a survey regarding the effectiveness of the Board of Directors to all directors and Audit & Supervisory Board Members, and received responses from everyone. The Board of Directors’ secretariat collected the responses and analyzed the details.

Considering the opinions of outside directors and outside Audit & Supervisory Board Members that were based on the results of analysis, the Company analyzed and evaluated the effectiveness of the Board of Directors as a whole at the Board of Directors meeting held on August 8, 2024 and discussed the current issues and future action policies.

Outline of evaluation results (Fiscal 2023)

As a result of the evaluation, the Company confirmed that its board of directors was generally functioning properly. An outline of the results is as follows.

(1) The composition of the Company’s board of directors in terms of size and ensuring the independence and diversity of its independent outside directors is appropriate, while a framework is in place to enable the board of directors to make important management decisions and effectively oversee the execution of business.

(2) The board of directors fosters an environment in which its members can freely and openly express their opinions and receive useful advice from outside directors.

(3) In the previous fiscal year’s effectiveness evaluation, certain progress was identified, including the sharing of information and creation of opportunities for discussion, with respect to the issues regarding the ongoing monitoring of progress in achieving the goals of the medium-term management plan, including non-financial targets.

Some pointed out that the enhancement of information provision and appropriate follow-up by the board of directors to ensure the effective functioning of the board remained issues.

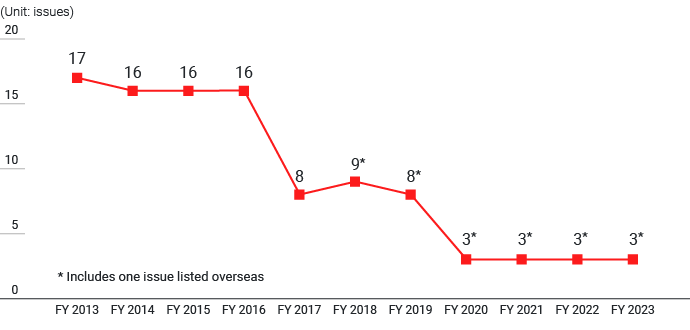

Cross-shareholdings

The number of shares of other companies that AMADA holds as cross-shareholdings shall be kept to the minimum necessary, and the Board of Directors shall annually assess whether or not to hold individual cross-shareholdings, closely examining whether the benefits and risks from each holding cover the Company’s cost of capital. Our policy is to proceed with the sale of any shares not deemed sufficiently significant to hold as a result of these examinations.

Furthermore, in the event that a holder of cross-shareholdings in the Company expresses an intention to sell the Company’s shares, the Company shall not prevent sale.

Number of issues held (listed stocks)

| Fiscal 2023 | Fiscal 2024 | |

|---|---|---|

| Number of issues held | 8 issues (3 listed / 5 unlisted) | 9 issues (3 listed / 6 unlisted) |

| Carrying value | ¥10,835 million | ¥6,572 million |

| Percentage of total assets | 1.59% | 1.01% |

Dialogue with shareholders and investors

AMADA actively enters into constructive dialogues with shareholders and investors with the aim of sustaining growth and boosting medium- to long-term corporate value.

Major AMADA Group attendees

Chairman, President, Director in charge of financial affairs, External directors, Finance Dept. General manager, Section manager, and members engaged in IR

Overview of shareholders and investors engaging in dialogues

In fiscal 2024, a cumulative total of approximately 450 companies, including institutional investors and analysts inside and outside Japan, participated in IR activities such as results briefings and individual interviews.

Major dialogue themes

Growth strategy direction and shareholder return policy in Medium-term Business Plan 2025, growing revenue and profitability, progress in regional strategies, streamlining the balance sheet, efforts to cultivate new markets.

Feedback of information gained in dialogue to upper management and the Board of Directors

When dialogues are held at results briefings, individual interviews, or other activities, reports are drafted summarizing dialogue content and the opinions of shareholders and investors, which are shared with AMADA officers and other parties. These reports are also presented to the Board of Directors as part of the IR activity summary each year

| Major activities in fiscal 2023 |

|

|

Anti-takeover measures

The Company does not utilize any anti-takeover measures.