Ownership of Shares

Ownership of Shares (As of March 31, 2024)

Total number of shares issued

341,115,217 shares

Number of shareholders

48,568

Major shareholders

| Shareholder | Shares owned (1,000 shares) |

Percent (%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust accounts) | 69,289 | 20.72 |

| CGML PB CLIENT ACCOUNT/COLLATERAL | 47,471 | 14.20 |

| MSIP CLIENT SECURITIES | 11,571 | 3.46 |

| THE AMADA FOUNDATION | 9,936 | 2.97 |

| SSBTC CLIENT OMNIBUS ACCOUNT | 6,138 | 1.84 |

| JAPAN POST INSURANCE Co., Ltd. | 6,077 | 1.82 |

| Nippon Life Insurance Company | 5,894 | 1.76 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 5,787 | 1.73 |

| THE BANK OF NEW YORK MELLON 140044 | 5,208 | 1.56 |

| JP MORGAN CHASE BANK 385781 | 4,604 | 1.38 |

Note: Ownership percentages have been calculated excluding treasury stock (16,537,149 shares).

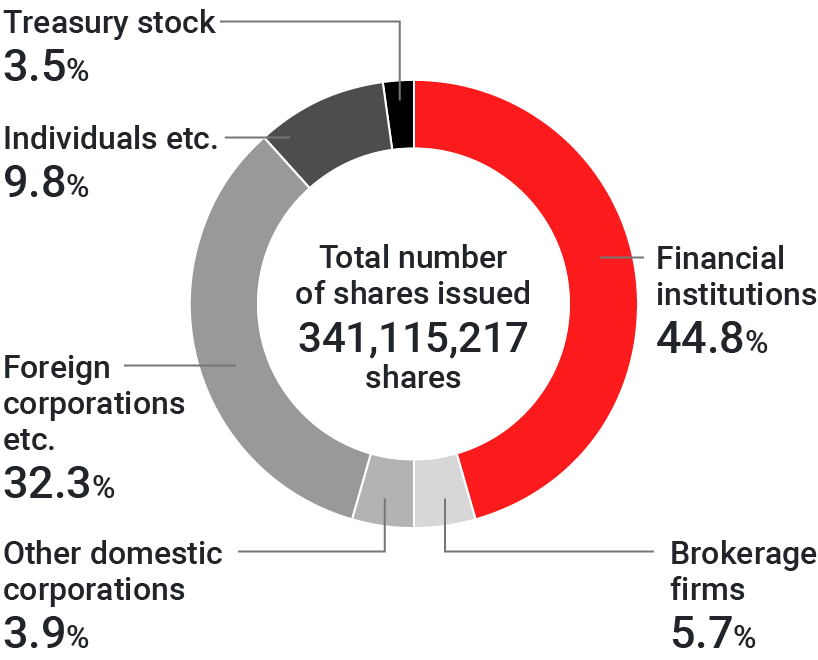

Distribution of shareownership by type of shareholder

Corporate bonds

No corporate bonds are issued at present.

Shareholder perks

We do not offer any shareholder perks at present.

Record of Transferring Shares and Capital

| Date | Total number of outstanding shares | Capital (million yen) |

Capital reserves (million yen) |

|||

|---|---|---|---|---|---|---|

| Increase /decrease in number | Balance | Amount changed | Balance | Amount changed | Balance | |

| April 1, 2000 *Note 1 |

48,597,340 | 338,502,186 | 2,429 | 54,752 | 43,782 | 117,779 |

| September 27, 2001 *Note 2 |

8,780 | 338,510,966 | 3 | 54,756 | 3 | 117,782 |

| October 1, 2002 *Note 3 |

237,149 | 338,748,115 | 11 | 54,768 | ― | 117,782 |

| October 1, 2003 *Note 4 |

67,686,002 | 406,434,117 | ― | 54,768 | 45,416 | 163,199 |

| August 23, 2007 *Note 5 |

△3,353,000 | 403,081,117 | ― | 54,768 | ― | 163,199 |

| March 31, 2009 *Note 5 |

△6,579,000 | 396,502,117 | ― | 54,768 | ― | 163,199 |

| June 30, 2014 *Note 5 |

△10,000,000 | 386,502,117 | ― | 54,768 | ― | 163,199 |

| November 30, 2015 *Note 5 |

△8,386,900 | 378,115,217 | ― | 54,768 | ― | 163,199 |

| March 29, 2019 *Note 5 |

△10,000,000 | 368,115,217 | ― | 54,768 | ― | 163,199 |

| March 31, 2020 *Note 5 |

△9,000,000 | 359,115,217 | ― | 54,768 | ― | 163,199 |

| March 29, 2024 *Note 5 |

△18,000,000 | 345,115,217 | ― | 54,768 | ― | 163,199 |

Figures show transfers from April 1, 2000 onwards.

Notes:

- Merged with AMADA METRECS CO., LTD. (merger ratio 1:0.873)

- Converted convertible bonds into shares

- Merged with AMADA ELECTRONICS CO., LTD. (merger ratio 1:0.143) and with AMADA ENGINEERING CENTER CO., LTD. (merger ratio 1:133.32)

- Merged with AMADA MACHINICS CO., LTD. (merger ratio 1:0.657)

- Retired shares