Corporate Governance

Basic Views on Corporate Governance

At the Company, we believe that sound corporate activities based upon high ethical standards and fairness make a crucial part of our business philosophy, and thus we shall endeavor to strengthen corporate governance according to the principles stated below, ensuring the transparency and compliance across our management and operations as our fundamental objective:

- (1) Strive to protect shareholders’ rights and ensure the equitable treatment of all shareholders

- (2) Strive to appropriately collaborate with stakeholders other than shareholders

- (3) Strive to ensure proper disclosure and transparency of information

- (4) Strive to have the board of directors appropriately fulfill its roles and responsibilities, reflecting upon fiduciary duty and accountability to the shareholders

- (5) Strive to have constructive dialogue with shareholders

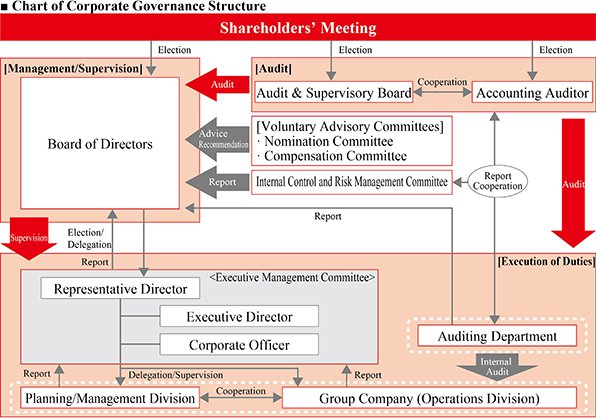

Current Corporate Governance System

The board of directors shall make decisions on statutory matters and other significant items concerning the overall management, at the same time as being a body that supervises business execution undertaken by directors. The board of directors, consisting of nine directors including four outside directors, holds a meeting as required and has a system that enables swift and flexible management decision-making.

The Company also has an audit and supervisory board, appointing four members, of which two are outside members. The audit and supervisory board members attend a board of directors meeting and other important meetings, entrusted with the mission of ensuring the sound management of the Company and an increase in social trust. They also oversee corporate governance by reviewing business conditions, and going through sales reports from the directors and inspections on the operational and financial situation, as well as by examining important documents.

The Company will continue to further enhance its organizational system and mechanism primarily with its legal functions such as a general shareholders’ meeting, the board of directors, audit and supervisory board and accounting auditors. At the same time, it will work to ensure accountability by having swift disclosure of management and financial information and being actively involved in IR activities.

Corporate Governance Guidelines

The Company shall set forth the Corporate Governance Guidelines for the purpose of clarifying the basic views and the initiatives to be taken by it concerning corporate governance.

Corporate Governance Report

For details of the Company’s corporate governance, please refer to the “Corporate Governance Report” that we have submitted to the Tokyo Stock Exchange.

Independence Standards for Outside Officers

The Company has established “Independence Standards for Outside Officers” with the aim of clarifying standards for the independence of outside directors and outside audit and supervisory board members.

Skill Matrix

Expertise and experience of each Director and Audit & Supervisory Board Member will be as follows.

| Name | Gender | Expertise, Experience | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate Management |

Finance Accounting |

Legal Affairs Risk Management Compliance |

Global | Sales Marketing |

R&D Manufacturing |

||||

| Directors |  |

Tsutomu Isobe | Male | 〇 | 〇 | 〇 | 〇 | ||

|

Takaaki Yamanashi | Male | 〇 | 〇 | 〇 | ||||

|

Masahiko Tadokoro | Male | 〇 | 〇 | 〇 | ||||

|

Koji Yamamoto | Male | 〇 | 〇 | 〇 | ||||

|

Kazuhiko Miwa | Male | 〇 | 〇 | 〇 | ||||

|

Hiroyuki Sasa Outside Independent |

Male | 〇 | 〇 | 〇 | 〇 | 〇 | ||

|

Toshitake Chino Outside Independent |

Male | 〇 | 〇 | |||||

|

Hidekazu Miyoshi Outside Independent |

Male | 〇 | 〇 | 〇 | ||||

|

Harumi Kobe Outside Independent |

Female | 〇 | 〇 | |||||

| Audit & Supervisory Board Members |  |

Kotaro Shibata | Male | 〇 | 〇 | 〇 | |||

|

Takashi Fujimoto | Male | 〇 | 〇 | |||||

|

Akira Takenouchi Outside Independent |

Male | 〇 | ||||||

|

Seiji Nishiura Outside Independent |

Male | 〇 | ||||||

Status of outside directors and outside audit and supervisory board members

The Company elected four outside directors in order to further enhance and strengthen its corporate governance. The outside directors and outside audit and supervisory board members are elected according to the Independence Standards for Outside Officers set by the Company, ensuring the selection of those who do not pose any risk of a conflict of interests with the general shareholders, and who are unable to be significantly influenced by the management and are unable to significantly influence the management.

Reasons for appointment of outside directors

| Name | Reasons for appointment | Board meeting attendance rate (Period ended in March 2023) Number of times of attendance/meetings |

|---|---|---|

| Hiroyuki Sasa | Mr. Hiroyuki Sasa, who served as Representative Director, President at Olympus Corporation, possesses insight as a business manager of a global corporation as well as broad knowledge of technologies and development in manufacturing business. Therefore, we have appointed Mr. Sasa as Outside Director, expecting that he will appropriately perform his duties as Outside Director of the Company based on his experience and knowledge. | — (New election) |

| Toshitake Chino | Mr. Toshitake Chino has expertise as company manager and insight into the industrial society acquired from his experience working as the editor and later president at Nikkan Kogyo Shimbun Ltd. From that perspective, he is overseeing business execution appropriately as Outside Director of the Company, such as by actively expressing his opinions at the Board of Directors meetings. As Chairman of the Compensation Committee and a member of the Nomination Committee, he attends meetings of these committees, where he gives timely and appropriate opinions. Therefore, we have appointed Mr. Chino as Outside Director, expecting that he will appropriately perform his duties as Outside Director of the Company based on his experience and knowledge. | 100% (8/8 meetings) |

| Hidekazu Miyoshi | Mr. Hidekazu Miyoshi has expertise in intellectual property rights, which he acquired through many years of service as a patent attorney, and experience as a business manager of a patent office. From that perspective, he is overseeing business execution appropriately as Outside Director of the Company, such as by actively expressing his opinions at the Board of Directors meetings. As a member of both the Nomination Committee and the Compensation Committee, he attends meetings of these committees, where he gives timely and appropriate opinions. Therefore, we have appointed Mr. Miyoshi as Outside Director, expecting that he will appropriately perform his duties as Outside Director of the Company based on his experience and knowledge. | 100% (8/8 meetings) |

| Harumi Kobe | Ms. Harumi Kobe has broad experience and a high level of expertise in Japan and abroad, which she acquired through many years of service at the Ministry of Finance, holding various important positions including serving as the first female Regional Commissioner of the Hiroshima Regional Taxation Bureau. From that perspective, she is overseeing business execution appropriately as Outside Director of the Company, such as by actively expressing her opinions at the Board of Directors meetings. Therefore, we have appointed Ms. Kobe as Outside Director, expecting that she will appropriately perform her duties as Outside Director of the Company based on her experience and knowledge. | 100% (7/7 meetings) |

Notes:

- There is a contract between the Company and the outside directors that limits their liability for damages, stipulated in Article 423, paragraph 1 of the Companies Act to the extent of the amount defined in Article 425, paragraph 1 of the Act as the minimum liability amount, pursuant to the provisions of Article 427, paragraph 1 of the Act.

- The Company has entered into a directors and officers liability insurance contract, including all Directors as insured parties. This contract will cover damages if Directors who are insured parties are found liable to pay compensation for damages resulting from their duties.

- Each outside director is an independent officer as defined in the provisions set forth by the Tokyo Stock Exchange, Inc.

- The attendance ratios of Messrs. Ms. Harumi Kobe at the Board of Directors meetings apply only to those held after their appointments on June 28, 2022.

Reasons for appointment of outside audit and supervisory board members

| Name | Reasons for appointment | Audit & Supervisory Board meeting attendance rate (Period ended in March 2023) Number of times of attendance/meetings |

|---|---|---|

| Akira Takenouchi | Mr. Akira Takenouchi is a lawyer familiar with legal affairs, and has broad experience and track record in the legal circle, including his position as President of TOKYO BAR ASSOCIATION. Therefore, although Mr. Takenouchi has never been directly involved in the management of a company, we have appointed him as a candidate for Outside Audit & Supervisory Board Member, having determined that he is an appropriate candidate capable of providing beneficial advice to the Company’s audit system based on his experience and knowledge. | 100% (9/9 meetings) |

| Seiji Nishiura | Mr. Seiji Nishiura, who served as district director of tax offices, etc., is well-versed in corporate taxation as a tax accountant and possesses high-level professional expertise in finance and accounting. Therefore, although Mr. Nishiura has never been directly involved in the management of a company, we have appointed him as a candidate for Outside Audit & Supervisory Board Member, having determined that he is an appropriate candidate capable of providing beneficial advice to the Company’s management and its audit system based on his experience and knowledge. | 100% (9/9 meetings) |

Notes:

- There is a contract between the Company and the outside audit and supervisory board members that limits their liability for damages, stipulated in Article 423, paragraph 1 of the Companies Act to the extent of the amount defined in Article 425, paragraph 1 of the Act as the minimum liability amount, pursuant to the provisions of Article 427, paragraph 1 of the Act.

- The Company has entered into a directors and officers liability insurance contract, including all Audit & Supervisory Board Members as insured parties. This contract will cover damages if Audit & Supervisory Board Members who are insured parties are found liable to pay compensation for damages resulting from their duties.

- Both of the outside audit and supervisory board members are independent officers as defined in the provisions set forth by the Tokyo Stock Exchange, Inc.

Voluntary Advisory Committees

In April 2020, the Company established the Nomination Committee and Compensation Committee, both of which are chaired by an outside director, to serve as voluntary advisory bodies for the Board of Directors with the purpose of utilizing the knowledge and advice of outside directors and enhancing the independence,objectivity, and accountability of the Board of Directors. Each committee is composed of four members, with three members—over half of each committee—being independent outside directors.

The Nomination Committee deliberates on the appointment and dismissal of directors, and the Compensation Committee deliberates on the policies and specifics of remuneration and other compensation received by directors and key employees.Both committees provide advice and recommendations to the Board of Directors.

| Independent outside directors | Internal director | |||

|---|---|---|---|---|

| Hiroyuki Sasa | Toshitake Chino | Hidekazu Miyoshi | Tsutomu Isobe | |

| Nomination Committee | Chairman | Member | Member | Member |

| Compensation Committee | Member | Chairman | Member | Member |

Cross-Shareholdings

- (1) Policies regarding cross-shareholdings

The number of shares of other companies that the Company holds shall be kept to the minimum necessary, and the Board of Directors shall annually assess whether or not to hold individual cross-shareholdings, closely examining whether the benefits and risks from each holding cover the Company’s cost of capital. Any cross-held shares, except for those that are deemed rational to continue to be held as a result of such assessment, will be sold. - (2) Policies regarding the exercise of voting rights associated with cross-held shares

The Company will vote for an agenda that it considers will contribute to increasing the value of shares it holds, whereas it will vote against if it believes that such agenda may damage the value of shares, after examining the business policies and strategies of the companies invested in.

Stock Options

Stock acquisition rights are not be issued.

Basic Anti-Corruption Policy

The AMADA Group has formulated the "Basic Anti-Corruption Policy" based on the AMADA Group Management Philosophy to "Conduct sound corporate activities based on high ethics and fairness," and all officers and employees* of the AMADA Group will comply with this policy.

For this policy, "corruption practice" refers to obtaining fraudulent gains through abuse of authority, including bribery, improper acceptance of kickbacks and rebates, embezzlement, money laundering, and obstruction of justice.

*"Employees" as defined in this policy includes regular employees, contract employees, temporary employees, part-timers, etc.

- 1. Legal compliance

All officers and employees of the AMADA Group will comply with anti-corruption laws and regulations applicable in all countries and regions where it conducts business activities. - 2. Prohibition of giving bribery

All officers and employees of the AMADA Group will not, directly or indirectly, provide or offer any improper benefits or favors to any public official, etc., or to any private company or other business entity that does not fall under the category of a public official. Any request or suggestion of bribery, etc. received will be firmly rejected. - 3. Prohibition of accepting bribery

All AMADA Group officers and employees will not accept or seek, directly or indirectly, any improper advantage or benefit from any person. - 4. Implementation of training and awareness-raising activities

To raise awareness and understanding of anti-corruption practices among all officers and employees, the AMADA Group will make this policy and related regulations constantly available on the company portal, etc. and will strive to further disseminate the policy through periodic training and other measures. In addition, by disclosing this policy on our website, we will strive to ensure that all stakeholders understand the AMADA Group's policy. - 5. Operation of whistle-blowing system and record retention

The AMADA Group protects the anonymity of whistleblowers and prohibits retaliatory treatment in the event of problems or suspicions regarding the prevention of corruption through a structure that allows for effective reporting through the whistleblower system. Upon receipt of a report, we will investigate and respond in good faith and take the necessary corrective actions. A series of records (including electronic records) concerning the receipt and investigation, etc. of whistleblower reports will be compiled and retained.

As described above, the AMADA Group will periodically verify whether this policy is functioning effectively and will review and improve it as needed.

Policy on Tax Transparency

The AMADA Group will strive to comply with the laws and regulations of all countries and regions in which it conducts business and pay appropriate taxes. In addition, under the Management Philosophy to "Conduct sound corporate activities based on high ethics and fairness," we will contribute to the economic development of each country and region by ensuring tax transparency and paying appropriate taxes.

- 1. Tax governance

The Finance Department of AMADA CO., LTD. will collaborate with related departments and group companies under the supervision of the Finance Director who is ultimately responsible for tax governance. - 2. Tax compliance

We will comply with tax-related laws and regulations applicable in all countries and regions where we conduct business activities, file appropriate tax returns, and pay taxes. We also strive to respect both the letter and spirit of the laws. - 3. Tax risk management

Tax laws and regulations in the countries and regions where we conduct business are complex, and tax risks exist due to their room for interpretation. For complex matters, we consult with external tax advisors to avoid risks. - 4. Tax planning

We do not engage in intentional tax avoidance or tax planning that is abusive by taking advantage of tax havens in regions where we have no actual business presence. - 5. Transfer pricing

In compliance with the OECD Transfer Pricing Guidelines, we will strive to avoid double taxation internationally by conducting transactions among group companies at arm's length prices appropriate to their functions and risks. - 6. Application of tax incentives

We will strive to reduce tax costs through the application of appropriate tax incentives in compliance with applicable tax laws and regulations in each country and region. - 7. Relations with tax authorities

We will strive to file appropriate tax returns and pay taxes in each country and region, respond with sincerity to requests from tax authorities, and build and maintain good relationships with them. If differences of opinion with the tax authorities arise, we will endeavor to resolve them through constructive dialogue.

Adoption of Anti-Takeover Measures

Not Adopted

Contact for repair/recovery of AMADA products and our corporate activities.